Infineon Mobile Phones & Portable Devices Driver Download For Windows

- Infineon Mobile Phones & Portable Devices Driver Download For Windows 7

- Infineon Mobile Phones & Portable Devices Driver Download For Windows 8

Infineon's 2002+ platform brings camera functionality, polyphonic-ring tones, color displays and Java capability to mid-range mobile phones. Featuring all hardware and software components required for camera-capable phones, it has the potential to reduce the development time of mobile phones and their derivatives by 25 percent to 50 percent. Samsung and Infineon Demonstrate Smart Phone System Solutions on Feb 17, 2003 Samsung Electronics and Infineon Technologies today announced strategic alliance to provide a comprehensive smartphone system solution, based on the Symbian OS, expected to significantly reduce development time.

Apple Should Buy Infineon to Own Mobile And Screw Intel

Posted in Mobile, Strategy

Apple’s earnings and revenue growth in mobile have been awe-inspiring to witness. From zero presence three years ago, Apple is now the most profitable cell phone maker in the world.

Apple’s success in this compressed period has helped it become an enormous buyer of components. In fact iSuppli projects that next year Apple will become the second-largest semiconductor buyer worldwide and may edge out HP in 2012 to become the world’s largest.

Though this scale presents Apple with enormous bargaining power, it also begs the question: Should Apple own its own wireless chip development?

This week’s rumors that Intel is about to acquire Infineon’s wireless chip business to make a run at the smartphone market bring this question front and center. Infineon is Apple’s sole supplier for cellular basebands, the core chipsets used in mobile phones to handle voice and data communications.

Based on Apple’s deep relationship with Infineon, and its famed secrecy around M&A, it is a pretty safe bet that Steve Jobs is analyzing the implications of a deal.

Vertical Integration is Back In Vogue:

We are re-entering a period where companies are integrating vertically instead of horizontally. This is happening at an incredible pace at companies like Cisco and Oracle. Even Microsoft recently hinted at creating its own chips, by obtaining an architectural license for ARM processors.

There are even precedents in the mobile phone market—both Nokia and Ericsson successfully managed cellular chip teams up until 2007 before spinning them off in a quest to move up the services stack.

The fact is that despite Apple’s success with the A4, it trails nearly all other large hardware companies in chip development, including Cisco, Sony, and IBM.

Synergies Between Infineon and Apple are Significant:

In addition to having supplied every cellular baseband chip that Apple has ever bought, Infineon is one of only four companies with an ARM architectural license (Qualcomm, Marvell, and now Microsoft are the other three). This allows Infineon to extend ARM’s basic capabilities, and is clearly synergistic with the charter of PA Semi and Intrinsity, which were acquired by Apple for their respective ARM expertise.

But below the surface, the rationale for Apple owning wireless technology runs even deeper.

Because Apple primarily sells just one hardware version per year, it’s infinitely easier for it to match devices with features. Nokia got rid of its chip business because it was impossible to produce different variants of chips for hundreds of handsets.

In this way, it’s Apple’s minimalistic approach to hardware that makes it the perfect candidate for vertical integration at the wireless level, as R&D can be narrowly focused. For example, if Apple’s not going to release a 4G handset in 2011, they don’t need to worry about cramming in pre-release versions of LTE / 3GPP. Or if they are strategically planning around short range wireless micro-payments, they can begin to integrate NFC technology now.

This edge could conceivably help Apple out-innovate larger competitors like Qualcomm who must produce more generic chips which cater to the needs of the broader market.

Lastly, since Infineon is only the fourth largest 3G baseband provider, there are fewer OEM customer relationships to phase out following the acquisition (LG and Nokia are its next biggest customers and wouldn’t be happy buying from Apple, so would turn elsewhere for subsequent designs). But precisely because Infineon is a smaller player, this issue of buying into the supply-chain is entirely manageable.

Apple could also learn better practices in RF design from Infineon, clearly a weak spot per the recent antenna issues.

Financially, It Makes Sense:

Apple can do no wrong right now with Wall Street. That’s why 2010 is an ideal time for “risky M&A” in the wireless space. With its stock at an all-time high and with over $40 billion in cash, Apple can afford to strategically spend capital on expanding into wireless chip development.

Infineon’s wireless group did $1.2 billion in sales last year, and comparable transactions suggest a premium of about 1.5x sales, or a $2 billion dollar price-tag.

Let’s compare this to the ridiculous rumor in April that Apple was going to buy ARM, the maker of semiconductor IP that goes into all of the world’s cell phones. At that time I outlined why buying ARM for more than $5 billion made zero sense. Clearly acquiring Infineon for around $2 billion absolutely does make sense.

And here’s the real crux: If Infineon is acquired by Intel or Samsung, Apple won’t ever be able to obtain wireless technology at this price again. Every other chip vendor supplying cellular basebands is enormous and diversified across industries (Qualcomm, ST-Ericsson, MediaTek, Broadcom).

Not Owning Wireless Is Dangerous For Apple:

Aside from the synergies and advantages to owning wireless chip development, you can bet Steve Jobs is thinking about the risks of not doing so.

In the future, handset OEMs will buy “package solutions”, consisting of application processors (e.g. Apple’s A4, which give mobile phones computing power for handling software and applications), integrated connectivity chipsets (GPS, Wi-Fi, FM, Bluetooth, NFC), and multifunction radios—all from one vendor. Qualcomm is nearly there today, and Intel wants to combine Infineon with its Atom processors to get there.

This poses a threat to Apple, since Qualcomm and Intel will start to integrate portions of digital interface logic into their application processors in proprietary ways in an effort to promote bundled solutions. This will marginalize Apple’s ability to marry merchant wireless chipsets with subsequent variations of its A4 application processor.

And it’s why vertically integrating “half-way” is a dangerous journey for Apple as mobile innovation accelerates and integration levels skyrocket. The truth is Apple is a different company today than before it entered the mobile world. Picking up Infineon would give Apple all the necessary pieces listed above to completely control its future as a mobile device company.

And if Apple misses out, it will likely never get another chance to acquire the wireless technology necessary to do so because the entire mobile component value-chain is consolidating and the remaining players are giants.

Which is exactly why Intel is rumored to be salivating so much at the prospect of snapping up Infineon for itself. Intel has big ambitions in mobile and understands why it can’t let this one get away. The only real question is whether Apple wants to get into a bidding war with Intel.

Comments are closed.

Intel reportedly is on the verge of buying Infineon's wireless chip business, several months after rumors of such a deal began surfacing and a week after the giant chip maker surprised the industry with its proposed $7.68 billion acquisition of security software vendor McAfee.

Citing unnamed people close to the negotiations, Bloomberg and the Wall Street Journal both reported Aug. 26 that negotiations between Intel and Infineon have advanced to the point where a deal could be announced before the end of the month.

The sources put the price around $1.9 billion, according to the reports.

Intel executives are pushing to expand the company's reach beyond the core PC and server businesses. Infineon's wireless technology, which can be found in such devices as Apple's iPhone and Samsung's Galaxy S smartphone, would give Intel a way into the booming mobile phone market, where Intel is virtually absent.

Further reading

Intel officials have been looking to position its Atom processors, initially developed for such devices as netbooks, as a possible wireless platform, but Infineon's business would give Intel a quicker path into the space.

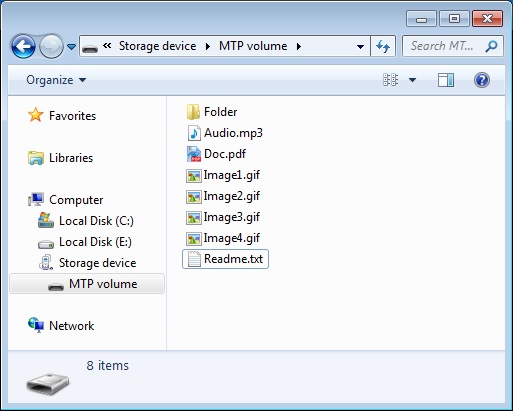

Infineon Mobile Phones & Portable Devices Driver Download For Windows 7

Advanced Micro Devices traditionally has been Intel's key competitor in the PC and server markets. However, some Intel executives point to ARM, which designs processors that are built by the likes of Texas Instruments and Qualcomm and are found in a large percentage of mobile phones and embedded devices, a market Intel wants to get into.

Samsung, which also builds processors using ARM's chip designs, also has been rumored to be interested in Infineon's mobile chip business, but according to the Wall Street Journal, Infineon prefers Intel's offer because it would 'bring more money than a joint venture with Samsung,' one of the newspaper's sources said.

Infineon Mobile Phones & Portable Devices Driver Download For Windows 8

A deal would come on the heels of Intel's announcement last week that it wants to buy McAfee to help bring greater security features to its processor portfolio.